Consumer Climate

GfK Consumer Climate January 2025: False Start to The New Year

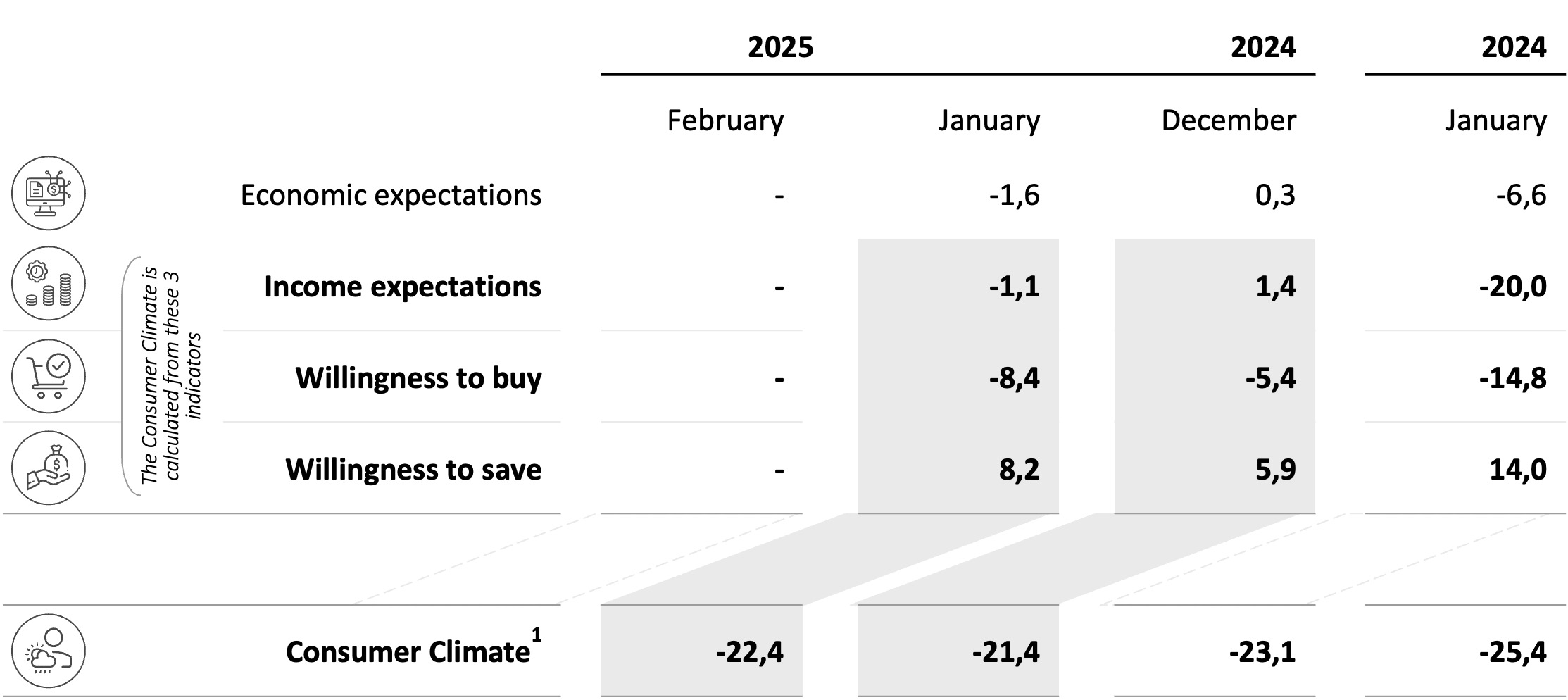

Nuremberg, January 29, 2025 – Consumer sentiment in Germany begins the new year with a bumpy start. Both economic and income expectations as well as the willingness to buy suffered losses in January. The willingness to save, on the other hand, recorded slight increases. As a result, the Consumer Climate declines in the forecast. Compared to the previous month (revised -21.4 points), a decrease of one point to -22.4 points is forecast for February 2025. These are the current findings of the GfK Consumer Climate powered by NIM, which has been published jointly by GfK and the Nuremberg Institute for Market Decisions (NIM), the founder of GfK, since October 2023.

In addition to the negative trend in income expectations and the willingness to buy, the decline of the Consumer Climate is also being driven by a rising willingness so save: It has risen by 2.3 points compared to the last month of the previous year and currently stands at 8.2 points.

"The Consumer Climate has suffered another setback and starts gloomy into the new year. The few hopes of a cautious recovery that emerged after the rise in the previous month were dashed. Since the middle of last year, we have seen a stagnating trend at best, while in the first half of 2024 the signs were still pointing to recovery," explains Rolf Bürkl, consumer expert at NIM. "A sustainable recovery in the Consumer Climate is currently not in sight, especially as the inflation rate has also risen again recently."

Economic pessimism increases slightly at the start of the year

At the end of 2024, Germans' opinion of how the general economic situation in Germany will develop over the next 12 months improved slightly. However, this was apparently just a flash in the pan. The indicator suffered a setback at the start of 2025: It falls by 1.9 points and currently stands at -1.6 points.

According to first calculations by the Federal Statistical Office, the German economy shrank by 0.2 percent last year. This is the second year of recession in a row. In 2023, the decline was 0.3 percent. And the growth prospects for this year are also rather moderate. Forecasts have recently been permanently revised downwards and currently stand at around half a percent growth in real gross domestic product.

Income expectations start the new year with slight losses

Assessments about how the financial situation of one’s own household will develop in the next 12 months are also less positive. This is because at the start of the year, income expectations have lost around half of their gains from the previous month. The indicator lost 2.5 points and now stands at -1.1 points. Last December, it had still gained 4.9 points.

Looking at the development of the income indicator over the past year, it is characterized by two different phases: The first half of the year was dominated by a noticeable recovery in income expectations, which was then replaced by a downward trend in the second half. This trend corresponds with the real income development of private households in Germany, which was particularly positive in the first half of 2024.

Willingness to buy in the wake of declining income prospects

The declining income prospects are a key reason for the weaker willingness to buy. The indicator lost 3 points and fell to -8.4 points. This is the lowest value since August 2024, when -10.9 points were measured.

The inflation rate in Germany has recently increased again. According to initial preliminary calculations by the Federal Statistical Office, prices rose by 2.6 percent in December compared to the previous year. This is likely to have had a dampening effect not only on income prospects but also on consumer spending. In addition, the ongoing news of factory closures and production relocations is causing increasing concern among the population about their own jobs. This is also affecting the consumer sentiment.

The following table shows the values of the individual indicators in January 2025 compared to the previous month and previous year:

1 Consumer sentiment can be interpreted as a leading indicator of consumer behavior in Germany. Analyses have shown that sentiment is an early indicator for the actual development of private consumption. The Consumer Climate is calculated from the January values for income expectations, willingness to buy and willingness to save - as a leading indicator for the development of consumption in February 2025.

The following diagram shows the development of the Consumer Climate indicator over the last few years:

Planned publication dates 1st half of 2025 (CET):

- Wednesday, 26.2.2025, 8:00 a.m.

- Friday, 28.03.2025, 8:00 a.m.

- Tuesday, 29.4.2025, 8:00 a.m.

- Tuesday, 27.5.2025, 2025, 8:00 a.m.

- Thursday, 26.6.2025, 8:00 a.m.

About our method

The survey period for the current analysis was from January 2 to 13, 2025. The results are extracted from the “GfK Consumer Climate powered by NIM” study and are based on around 2,000 consumer interviews per month conducted on behalf of the European Commission. The report presents the indicators in the form of graphics accompanied by brief comments. Consumer sentiment refers explicitly to all private consumer spending. Depending on the definition used, however, retail accounts for only around 30 percent of private consumer spending. Services, travel, housing costs, healthcare services, and the wellness sector as a whole account for the rest. Again, this does not apply to retail sales, but instead to total consumer spending. Like all other indicators, willingness to buy is a confidence indicator. It indicates whether consumers currently consider it advisable to make larger purchases. Even if they answer “Yes” to this question, there are two further requirements for making a purchase: The consumer must have both money required for such a large purchase and must also see a need to make this purchase. Furthermore, this only concerns durable consumer goods that also require a larger budget.

GfK Consumer Climate powered by NIM

The GfK Consumer Climate survey, which is being conducted regularly since 1974 and monthly since 1980, is regarded as an important indicator of German consumer behavior and a guiding light for Germany’s economic development. Since October 2023, the Consumer Climate data collected by GfK has been analyzed and published jointly with the Nuremberg Institute for Market Decisions (NIM), the founder of GfK. By joining forces, it will be possible to invest further in the analysis and development of the Consumer Climate study to gain an even better understanding of the background to changes in consumer confidence.

Media Contact:

GfK: Corina Kirchner, T +49 911 395 4570, corina.kirchner@nielseniq.com

NIM: Sandra Lades, T +49 911 95151 989, sandra.lades@nim.org

GfK – a NielsenIQ company

For 90 years, clients around the world have trusted us to provide data-driven answers to key questions for their decision-making processes. We support their growth through our comprehensive understanding of buying behavior and the dynamics that influence markets, brands, and media trends. In 2023, industry leaders GfK and NielsenIQ have merged to offer their clients unparalleled global reach. With a holistic view of retail and the most comprehensive consumer insights, provided by forward-looking analytics on state-of-the-art platforms, GfK is driving “Growth from Knowledge.” More information is available at www.nielseniq.com.

Nuremberg Institute for Market Decisions

The Nuremberg Institute for Market Decisions (NIM) is a non-profit research institute at the interface of academia and practice. NIM examines how consumer decisions change due to new technology, societal trends or the application of behavioral science, and what the resulting micro- and macroeconomic impacts are for the market and for society as a whole. A better understanding of consumer decisions and their impacts helps society, businesses, politics, and consumers make better decisions with regard to “prosperity for all” in the sense of the social-ecological market system.

The Nuremberg Institute for Market Decisions is the founder of GfK.

Further information is available at https://www.nim.org/en and LinkedIn.

![[Translate to English:] [Translate to English:]](/fileadmin/PUBLIC/1_NIM_NIM/Team/R.Buerkl_NIM.png)