Consumer Climate

2024

GfK Consumer Climate June 2024: The Recovery of The Consumer Climate Takes a Break

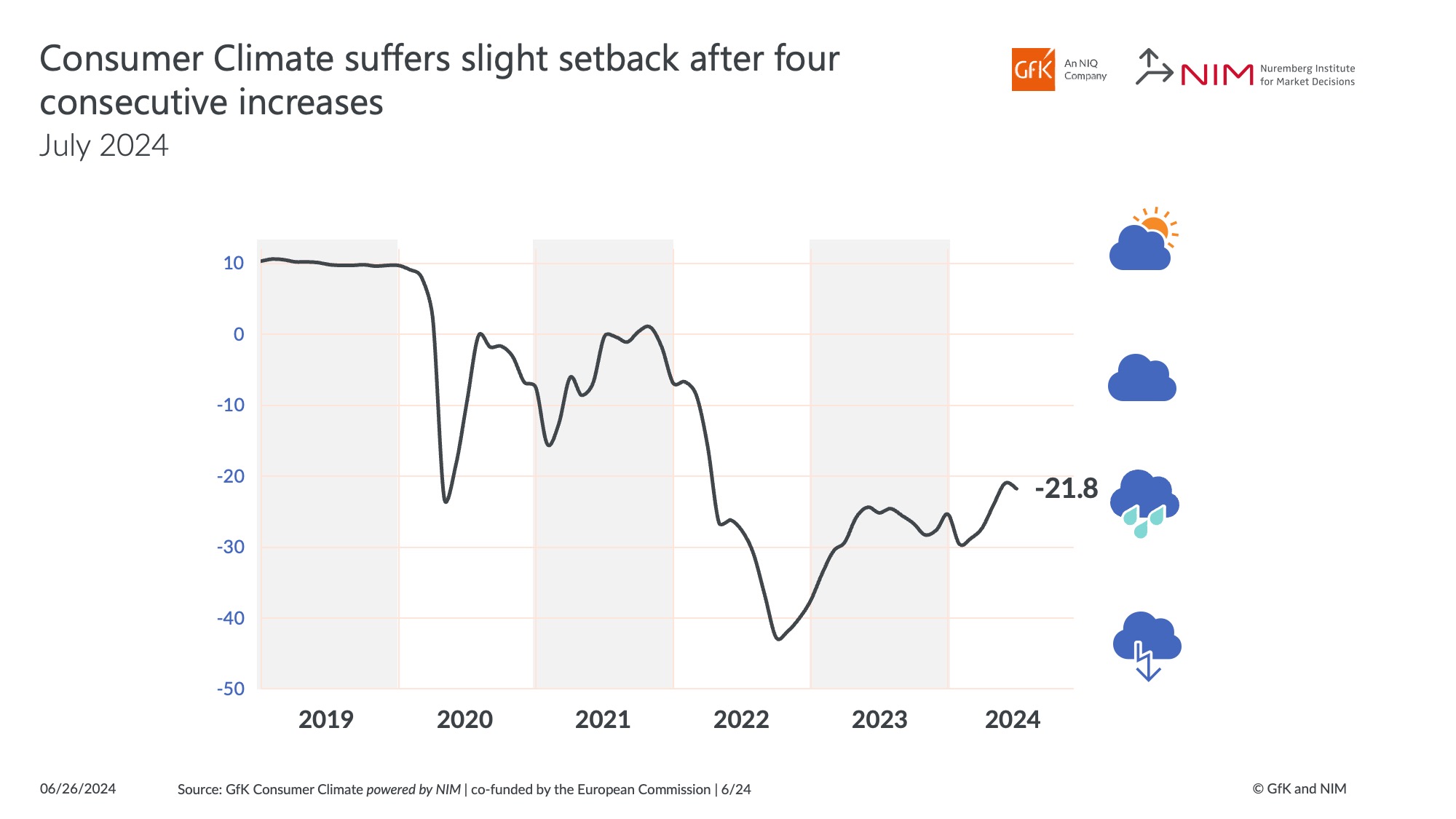

Nuremberg, June 26, 2024 - The recovery in consumer sentiment in Germany comes to a standstill for the time being in June. Both income and economic expectations suffered moderate losses. The willingness to buy fell slightly compared to the previous month and thus continues to stagnate at a very low level. The willingness to save, on the other hand, has increased slightly, consolidating its already high level. Taking these developments into account, the consumer climate is declining slightly overall: in the forecast for July, the indicator falls by 0.8 points to -21.8 points – compared to the previous month (revised to -21.0 points). These are the current findings of the GfK Consumer Climate powered by NIM, which has been published jointly by GfK and the Nuremberg Institute for Market Decisions (NIM), the founder of GfK, since October 2023.

After four increases in a row, the consumer climate has now suffered a small setback. In addition to the slight decline in income expectations, this is mainly due to the willingness to save, which rose by 3.2 points to 8.2 points in June.

"The interruption of the recent upward trend in consumer sentiment shows that the road out of the sluggish consumption will be difficult and there can always be setbacks," explains Rolf Buerkl, consumer expert at NIM. "The slightly higher inflation rate in Germany in May is clearly causing more uncertainty among consumers again, which is also reflected in the increase in the willingness to save. For a sustained recovery in consumer sentiment, consumers need – in addition to the existing real income growth – planning security, which is particularly necessary for larger household purchases. And this security will only return if the upward pressure on prices is further dampened and if consumers are shown clear future prospects. This also means that the government must quickly and clearly communicate the burdens and reliefs people will face as a result of the upcoming budget discussions. Then the noticeable real income increases can be prevailed and consumers are willing to spend more," says Rolf Buerkl.

The upward trend in income expectations has come to a halt

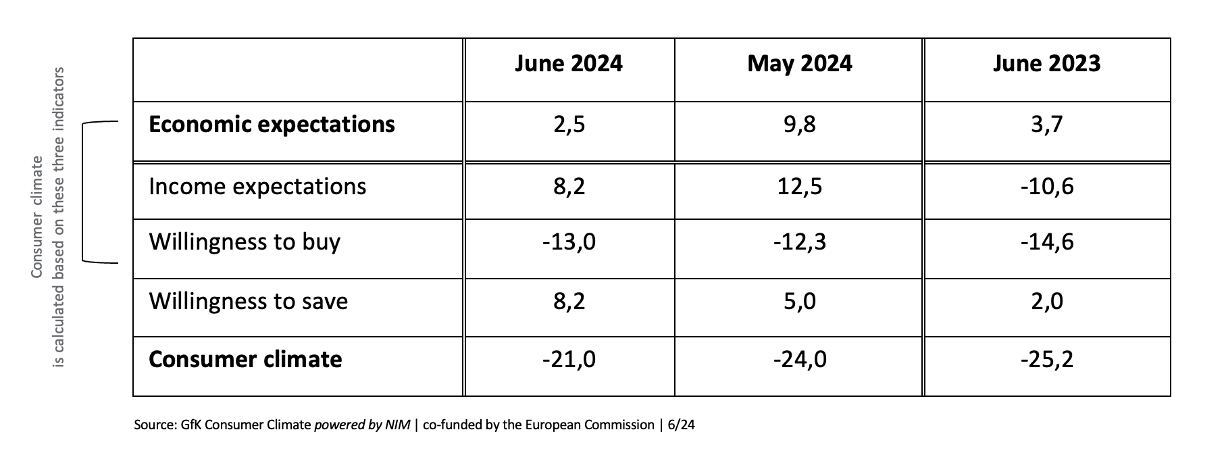

The clear upward trend in income expectations comes to a standstill in June - at least for the time being. After four consecutive increases, the indicator lost 4.3 points and fell to 8.2 points. Nevertheless, the increase compared to the same period last year is almost 19 points.

The main reason for the moderate decline in income expectations is likely to be the rise in the inflation rate. According to the Federal Statistical Office, the inflation rate in Germany was 2.4 percent in May of this year, after 2.2 percent in March and April. It has therefore moved slightly away from the European Central Bank's (ECB) target of around 2 percent. The influence of inflation on income expectations is confirmed by an in-depth analysis of income expectations – carried out by the NIM this June. In an open survey, 62 percent of respondents mentioned rising prices as the main reason for their income pessimism.

The willingness to buy remains at a low level

Consumers' willingness to buy continues to show little movement. The indicator has remained at an extremely low level for more than two years now. This month, it lost 0.7 points and now stands at -13 points. Compared to the same period last year, a small increase of 1.6 points was measured.

The current reluctance to buy is largely due to rising prices. If private households have to spend more on food and energy, there is a lack in the financial resources for larger purchases. In addition, the missing planning security means that people are more likely to build up reserves for emergencies or similar, which are therefore also not available for consumption.

Hopes of a rapid economic recovery are dampened

The hopes of Germans for a rapid economic recovery in the course of this year were dampened in June. After four consecutive increases, the economic indicator lost 7.3 points and fell to 2.5 points.

Despite the decline in June, it can be assumed that the economic recovery in Germany is likely to continue in the second half of the year. However, consumers expect it to be rather weak. Some economic experts do not expect to see a slight acceleration until next year.

The following table shows the values of the individual indicators in June 2024 compared to the previous month and previous year:

Planned publication dates 2024 (CET):

Wednesday, July 24, 2024, 8 a.m.

Tuesday, August 27, 2024, 8 a.m. -> Note: the publication date is now 1 day earlier (before: 28th August)

Thursday, September 26, 2024, 8 a.m.

Tuesday, October 29, 2024, 8 a.m.

Wednesday, November 27, 2024, 8 a.m.

Thursday, December 19, 2024, 8 a.m.

About our method

The survey period for the current analysis was May 30 to June 10, 2024. The results are extracted from the “GfK Consumer Climate powered by NIM” study and are based on around 2,000 consumer interviews per month conducted on behalf of the European Commission. The report presents the indicators in the form of graphics accompanied by brief comments. Consumer sentiment refers explicitly to all private consumer spending. Depending on the definition used, however, retail accounts for only around 30 percent of private consumer spending. Services, travel, housing costs, healthcare services, and the wellness sector as a whole account for the rest. Again, this does not apply to retail sales, but instead to total consumer spending. Like all other indicators, willingness to buy is a confidence indicator. It indicates whether consumers currently consider it advisable to make larger purchases. Even if they answer “Yes” to this question, there are two further requirements for making a purchase: The consumer must have both money required for such a large purchase and must also see a need to make this purchase. Furthermore, this only concerns durable consumer goods that also require a larger budget.

GfK Consumer Climate powered by NIM

The GfK Consumer Climate survey, which is being conducted regularly since 1974 and monthly since 1980, is regarded as an important indicator of German consumer behavior and a guiding light for Germany’s economic development. Since October 2023, the Consumer Climate data collected by GfK has been analyzed and published jointly with the Nuremberg Institute for Market Decisions (NIM), the founder of GfK. By joining forces, it will be possible to invest further in the analysis and development of the Consumer Climate study to gain an even better understanding of the background to changes in consumer confidence.

Media Contact:

GfK: Eva Böhm, T +49 911 395 4440, public.relations@gfk.com

NIM: Sandra Lades, T +49 911 95151 989, sandra.lades@nim.org

GfK. Growth from Knowledge.

For over 89 years, clients around the world have trusted us to provide data-driven answers to key questions for their decision-making processes. We support their growth through our comprehensive understanding of buying behavior and the dynamics that influence markets, brands, and media trends. In 2023, industry leaders GfK and NIQ have merged to offer their clients unparalleled global reach. With a holistic view of retail and the most comprehensive consumer insights, provided by forward-looking analytics on state-of-the-art platforms, GfK is driving “Growth from Knowledge.”

More information is available at www.gfk.com.

Nuremberg Institute for Market Decisions

The Nuremberg Institute for Market Decisions (NIM) is a non-profit research institute at the interface of academia and practice. NIM examines how consumer decisions change due to new technology, societal trends or the application of behavioral science, and what the resulting micro- and macroeconomic impacts are for the market and for society as a whole. A better understanding of consumer decisions and their impacts helps society, businesses, politics, and consumers make better decisions with regard to “prosperity for all” in the sense of the social-ecological market system.

The Nuremberg Institute for Market Decisions is the founder of GfK.

Further information is available at https://www.nim.org/en and LinkedIn.

![[Translate to English:] [Translate to English:]](/fileadmin/PUBLIC/1_NIM_NIM/Team/R.Buerkl_NIM.png)