Consumer Climate

GfK Consumer Climate August 2024: Significant Setback

Nuremberg, August 27, 2024 - After the recovery in the previous month, consumer sentiment in Germany suffers a severe setback in August. Income and economic expectations show noticeable losses and the willingness to buy also falls slightly. As the willingness to save rises this month, the Consumer Climate declines: in the forecast for September, it falls by 3.4 points compared to the previous month (revised -18.6 points) to -22.0 points. These are the current findings of the GfK Consumer Climate powered by NIM, which has been published jointly by GfK and the Nuremberg Institute for Market Decisions (NIM), the founder of GfK, since October 2023.

The Consumer Climate is currently suffering mainly from the slump in income expectations. The slight increase in the willingness to save by 2.7 points also dampens consumer sentiment.

"Apparently, the euphoria of German Consumers triggered by the European Football Championship was only a brief flare-up and faded after the end of the tournament. In addition, negative news about job security is making consumers more pessimistic and a fast recovery in consumer sentiment seems unlikely," explains Rolf Buerkl, consumer expert at NIM. "Slightly rising unemployment rates, an increase in corporate insolvencies and staff reduction plans at various companies in Germany are causing employees to worry about their jobs. Hopes for a stable and sustainable economic recovery must therefore be further postponed."

Income expectations are falling noticeably

Private households in Germany currently see their financial situation over the next 12 months less positive than a month ago: the income expectations indicator loses 16.2 points and falls to 3.5 points. The last time income expectations fell more sharply within a month was in September 2022. At that time, private households suffered considerable losses in purchasing power due to inflation rates of almost 8 percent.

Many households are currently experiencing an increase in real purchasing power. Nevertheless, the uncertainty is rising as the concerns about job security is increasing again. The Federal Employment Agency recently reported a slight increase in unemployment rates in Germany. According to this, the number of people registered as unemployed is currently around 200,000 higher than a year ago.

Willingness to buy in the wake of falling income expectations

German consumers' willingness to buy is affected by the significant drop in income expectations. However, at 2.5 points, the losses are comparatively moderate. The indicator shows -10.9 points in August. Compared to the same period last year, there is still an increase of 6 points.

Economic expectations in ups and downs

The ups and downs of the economic expectations, which have been observed since May 2024, continue in August. Following the significant increase of 7.3 points in the previous month, the indicator is currently down 7.8 points and stands at 2.0 points.

A weakening economy, job reduction plans in German industry, a rise in insolvency figures and an increasing risk of recession unsettle consumers and increase economic pessimism for the coming 12 months.

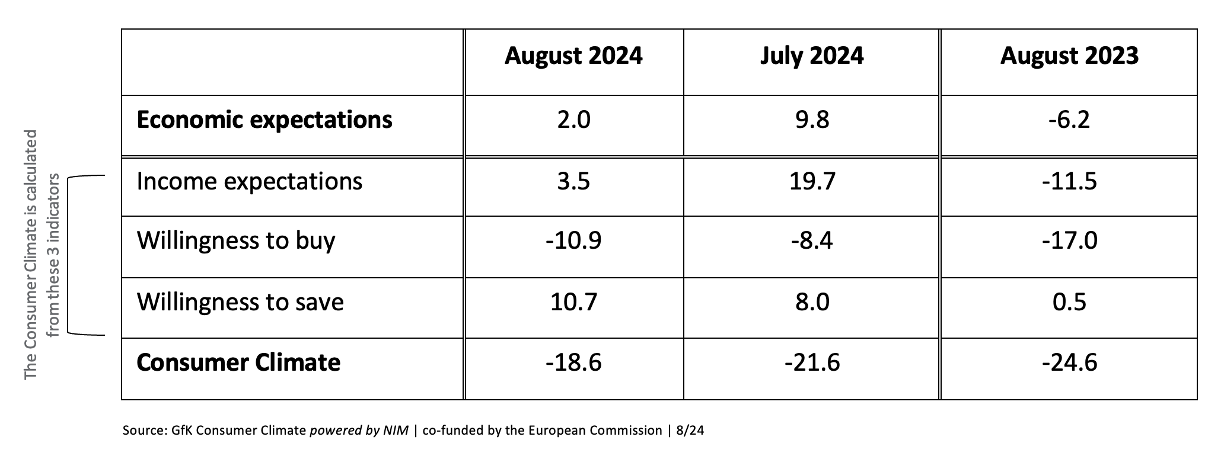

The following table shows the values of the individual indicators in August 2024 compared to the previous month and previous year:

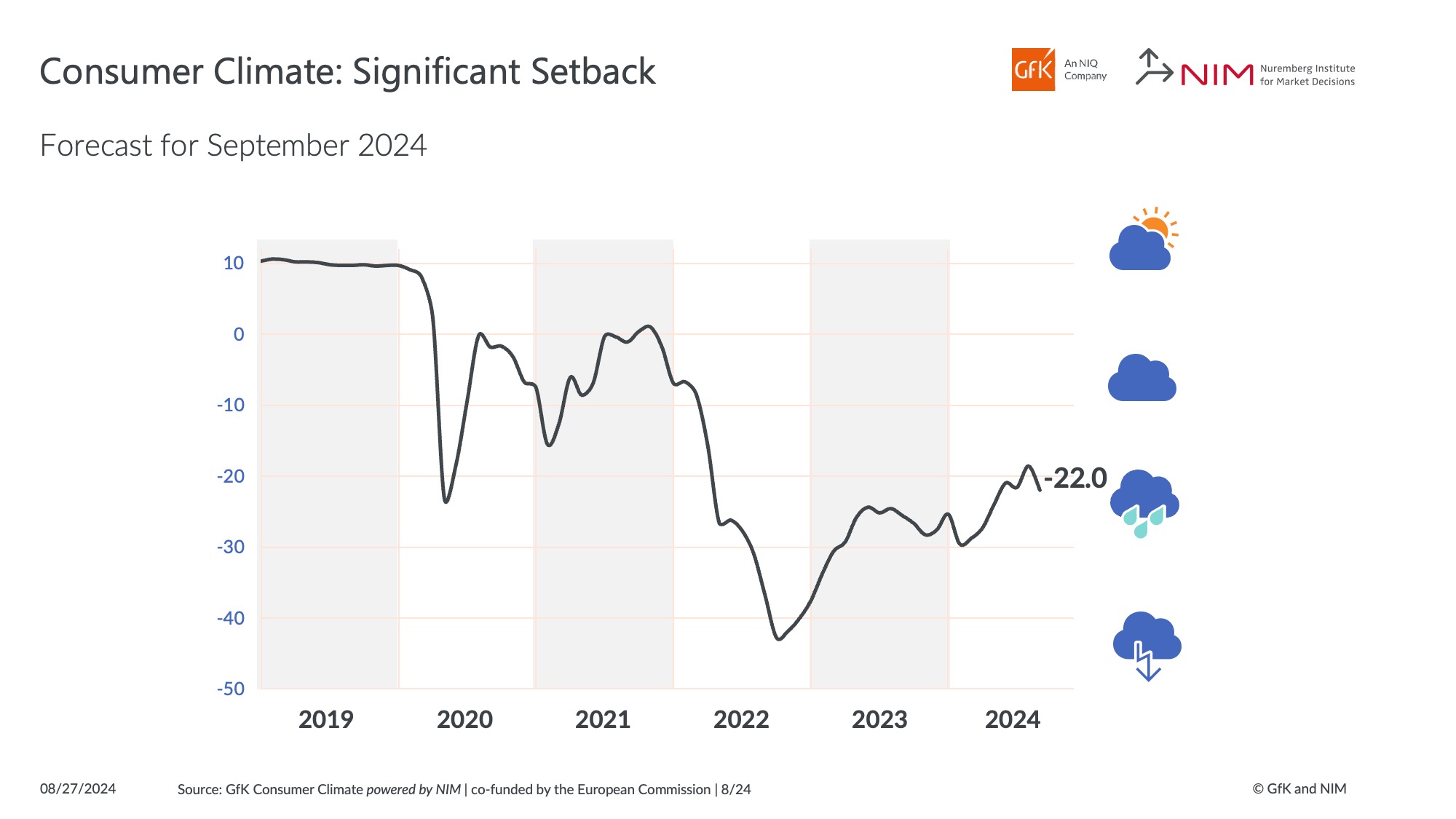

The following diagram shows the development of the Consumer Climate indicator over the last few years:

Planned publication dates 2024 (CET):

Thursday, September 26, 2024, 8 a.m.

Tuesday, October 29, 2024, 8 a.m.

Wednesday, November 27, 2024, 8 a.m.

Thursday, December 19, 2024, 8 a.m.

About our method

The survey period for the current analysis was August 1 to August 12, 2024. The results are extracted from the “GfK Consumer Climate powered by NIM” study and are based on around 2,000 consumer interviews per month conducted on behalf of the European Commission. The report presents the indicators in the form of graphics accompanied by brief comments. Consumer sentiment refers explicitly to all private consumer spending. Depending on the definition used, however, retail accounts for only around 30 percent of private consumer spending. Services, travel, housing costs, healthcare services, and the wellness sector as a whole account for the rest. Again, this does not apply to retail sales, but instead to total consumer spending. Like all other indicators, willingness to buy is a confidence indicator. It indicates whether consumers currently consider it advisable to make larger purchases. Even if they answer “Yes” to this question, there are two further requirements for making a purchase: The consumer must have both money required for such a large purchase and must also see a need to make this purchase. Furthermore, this only concerns durable consumer goods that also require a larger budget.

GfK Consumer Climate powered by NIM

The GfK Consumer Climate survey, which is being conducted regularly since 1974 and monthly since 1980, is regarded as an important indicator of German consumer behavior and a guiding light for Germany’s economic development. Since October 2023, the Consumer Climate data collected by GfK has been analyzed and published jointly with the Nuremberg Institute for Market Decisions (NIM), the founder of GfK. By joining forces, it will be possible to invest further in the analysis and development of the Consumer Climate study to gain an even better understanding of the background to changes in consumer confidence.

Media Contact:

GfK: Eva Böhm, T +49 911 395 4440, public.relations@gfk.com

NIM: Sandra Lades, T +49 911 95151 989, sandra.lades@nim.org

GfK. Growth from Knowledge.

For over 89 years, clients around the world have trusted us to provide data-driven answers to key questions for their decision-making processes. We support their growth through our comprehensive understanding of buying behavior and the dynamics that influence markets, brands, and media trends. In 2023, industry leaders GfK and NIQ have merged to offer their clients unparalleled global reach. With a holistic view of retail and the most comprehensive consumer insights, provided by forward-looking analytics on state-of-the-art platforms, GfK is driving “Growth from Knowledge.”

More information is available at www.gfk.com.

Nuremberg Institute for Market Decisions

The Nuremberg Institute for Market Decisions (NIM) is a non-profit research institute at the interface of academia and practice. NIM examines how consumer decisions change due to new technology, societal trends or the application of behavioral science, and what the resulting micro- and macroeconomic impacts are for the market and for society as a whole. A better understanding of consumer decisions and their impacts helps society, businesses, politics, and consumers make better decisions with regard to “prosperity for all” in the sense of the social-ecological market system.

The Nuremberg Institute for Market Decisions is the founder of GfK.

Further information is available at https://www.nim.org/en and LinkedIn.

![[Translate to English:] [Translate to English:]](/fileadmin/PUBLIC/1_NIM_NIM/Team/R.Buerkl_NIM.png)